Stripe has emerged as a leading payment processing software, revolutionizing how businesses handle online transactions. Founded in 2010, Stripe quickly gained traction due to its user-friendly interface, robust features, and seamless integrations. As a comprehensive solution, Stripe supports businesses of all sizes, from startups to large enterprises, enabling them to accept payments globally with ease.

In this Stripe software review, we aim to provide an in-depth analysis of Stripe’s features, benefits, and potential drawbacks. By exploring its key functionalities, pricing structure, security measures, and customer support, we will offer a clear understanding of what makes Stripe a preferred choice for many businesses. Additionally, this review will include updates specific to the latest version, making it a thorough Stripe software review 2024.

1. Overview of Stripe

Stripe was founded in 2010 by brothers Patrick and John Collison with the mission to simplify online payment processing for businesses of all sizes. Initially launched in the United States, Stripe quickly expanded its services globally, now operating in over 40 countries. The company’s vision was to create a seamless and developer-friendly platform that could handle the complexities of online payments, which they successfully achieved through innovative technology and a user-centric approach.

Stripe’s growth has been impressive. It started as a small startup and rapidly evolved into a major player in the fintech industry. Stripe’s ability to continually innovate and adapt to market needs has been a key driver of its success. The company has raised significant venture capital funding, with notable investors like Sequoia Capital, Andreessen Horowitz, and Tiger Global Management backing its expansion. This financial support has enabled Stripe to scale its operations and continuously enhance its offerings.

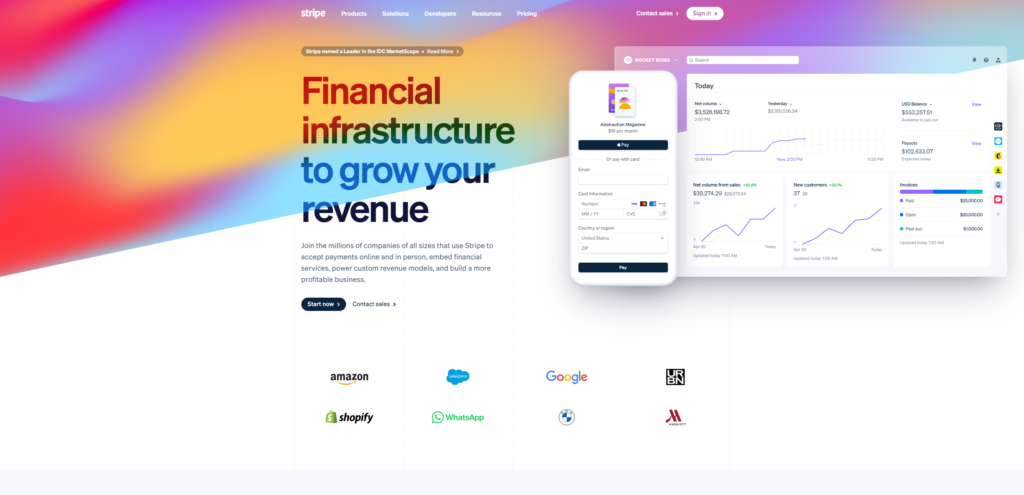

In terms of market presence, Stripe has established itself as a trusted and reliable payment processing solution for a diverse range of businesses. It serves millions of companies, from small startups to Fortune 500 corporations, across various industries including e-commerce, SaaS, retail, and more. Stripe’s robust infrastructure and wide array of features make it a go-to choice for businesses looking to streamline their payment processes.

Stripe’s platform is designed to be highly versatile and integrates seamlessly with numerous applications and services. Its comprehensive API toolkit allows developers to create custom payment solutions tailored to their specific needs, further solidifying Stripe’s position as a leader in the payment processing space.

2. Key Features of Stripe

Stripe stands out as a leading payment processing software, offering a comprehensive suite of features designed to simplify and optimize online transactions for businesses of all sizes. In this Stripe software review 2024, we will explore its core features in detail, highlighting what makes Stripe a preferred choice for many organizations.

Payment Processing Capabilities

Stripe’s primary function is to facilitate smooth and efficient payment processing. It supports a wide range of payment methods, including credit and debit cards, ACH transfers, and popular digital wallets like Apple Pay and Google Pay. Stripe’s infrastructure ensures high-speed transaction processing with minimal downtime, which is critical for businesses handling large volumes of payments. Additionally, Stripe provides advanced features such as recurring billing, invoicing, and support for one-click payments, making it an ideal solution for subscription-based and e-commerce businesses.

Integration Options with Various Platforms

One of Stripe’s standout features is its ability to seamlessly integrate with a variety of platforms and applications. Stripe offers pre-built integrations with popular e-commerce platforms like Shopify, WooCommerce, and Magento, as well as CRM systems and accounting software such as Salesforce and QuickBooks. Furthermore, Stripe’s extensive API toolkit enables developers to create custom integrations tailored to their unique business needs. This flexibility ensures that businesses can incorporate Stripe into their existing workflows without significant disruptions.

Security Measures and Compliance

Security is a top priority for Stripe, and it employs robust measures to protect sensitive financial data. Stripe is PCI-DSS Level 1 certified, the highest level of security certification in the payment industry, ensuring that all transactions are processed securely. Stripe uses advanced encryption technologies to safeguard data and implements machine learning algorithms to detect and prevent fraudulent activities. Additionally, Stripe is compliant with global regulations such as GDPR, ensuring that businesses can confidently use the platform while adhering to stringent data protection laws.

Global Reach and Currency Support

Stripe’s global reach is another critical feature that sets it apart from many competitors. Stripe supports businesses in over 40 countries and allows them to accept payments in more than 135 currencies. This extensive currency support is particularly beneficial for businesses with an international customer base, as it enables them to offer localized payment options, enhancing the customer experience. Moreover, Stripe’s multi-currency payout feature allows businesses to manage and settle transactions in different currencies, simplifying the financial management of global operations.

3. Benefits of Using Stripe

Stripe offers numerous benefits that make it a top choice for businesses seeking reliable payment processing. This Stripe software review highlights the key advantages that contribute to its popularity.

One notable benefit is Stripe’s ease of use and user-friendly interface. The platform is intuitive, allowing users with varying technical expertise to quickly set up and start processing payments without extensive training. The clean dashboard provides a clear overview of transactions, balances, and other critical metrics, enabling efficient financial management.

Scalability is another significant advantage. Stripe supports businesses of all sizes, from startups to large enterprises, and can handle increased transaction volumes as a business grows. This scalability ensures that businesses do not need to switch payment processors as they expand, saving time and resources.

For developers, Stripe offers a comprehensive API that allows for extensive customization. The well-documented API enables developers to create tailored payment solutions, build custom workflows, automate processes, and integrate Stripe seamlessly with other systems.

Strong customer support is another critical benefit. Stripe provides multiple support channels, including email, chat, and phone support, along with a wealth of online resources such as detailed documentation, guides, and a community forum. This robust support infrastructure ensures that businesses can quickly resolve any issues and maintain smooth payment operations.

4. Pricing and Fees

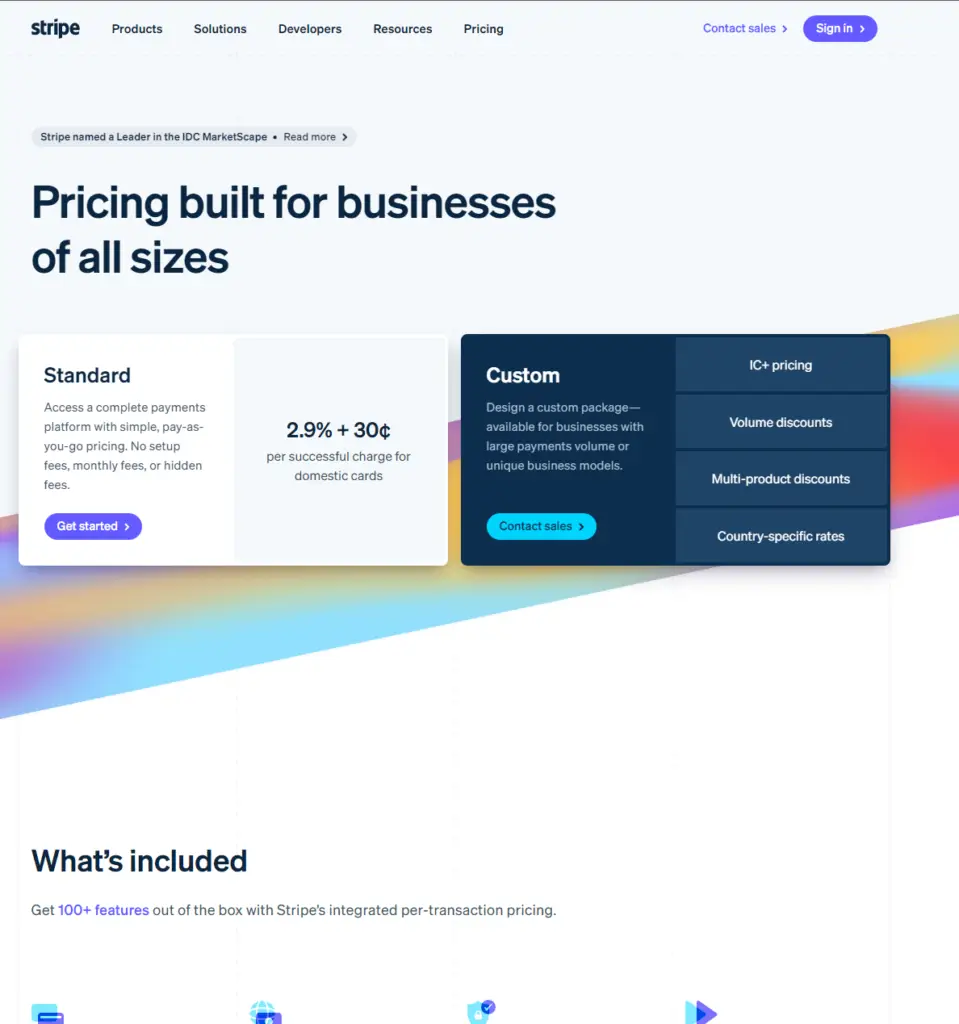

Stripe’s pricing model is straightforward and transparent, which is a significant advantage for businesses of all sizes. The standard fee for processing card payments is 2.9% + 30¢ per successful transaction. This flat-rate pricing structure makes it easy for businesses to predict costs and manage their budgets. For larger enterprises or businesses with high transaction volumes, Stripe offers customized pricing plans that can provide lower rates based on specific needs and transaction volumes.

When comparing Stripe’s pricing with competitors, it’s evident that Stripe is competitively priced. Many other payment processors, such as PayPal and Square, offer similar pricing structures, with fees hovering around the same 2.9% + 30¢ mark for standard transactions. However, Stripe often stands out due to its comprehensive features, global reach, and developer-friendly tools, which can justify the costs for many businesses. Additionally, Stripe does not charge setup fees, monthly fees, or hidden fees, making it an attractive option compared to some competitors that may have additional costs or complex pricing tiers.

One of the key aspects that users appreciate in Stripe is the absence of hidden fees. There are no charges for setting up an account or for maintaining it every month. Stripe also does not impose fees for failed transactions, which can be a hidden cost with some other payment processors. However, there are a few additional costs that businesses should be aware of. For instance, if you choose to enable international payments, there is an additional 1% fee on top of the standard transaction fee. Currency conversion also incurs an extra 1% fee. While these fees are clearly stated by Stripe and are relatively standard in the industry, businesses with significant international transactions should take them into account when forecasting their costs.

Furthermore, Stripe offers several advanced features and services that come with their own pricing. For example, Stripe Radar, which provides advanced fraud detection, is free for basic protection but offers premium features at a cost of 5¢ per screened transaction. Stripe Atlas, which assists with business incorporation and legal paperwork, charges a one-time fee of $500. These additional services are optional but can be valuable for businesses looking for comprehensive solutions beyond standard payment processing.

5. Pros and Cons of Stripe

Stripe has established itself as a leading payment processing solution, but like any software, it has its own set of advantages and limitations. This Stripe software review 2024 provides a balanced look at both the pros and cons, incorporating real-world user feedback and testimonials to offer a comprehensive perspective.

Pros

One of the most significant advantages of Stripe is its ease of use and user-friendly interface. Businesses can set up and start accepting payments quickly without needing extensive technical knowledge. The dashboard is intuitive, providing clear insights into transactions, balances, and other critical financial data.

Stripe’s scalability is another major plus. It is designed to support businesses of all sizes, from small startups to large enterprises. As a business grows, Stripe can handle increasing transaction volumes without compromising performance. This scalability ensures that businesses do not need to switch payment processors as they expand, saving time and resources.

Developers particularly appreciate Stripe’s comprehensive API, which allows for extensive customization and integration. The well-documented API enables developers to create tailored payment solutions and seamlessly integrate Stripe with existing systems. This flexibility is a significant advantage for businesses with unique requirements that cannot be met by standard solutions.

Security is a top priority for Stripe, and it employs robust measures to protect sensitive data. Stripe is PCI-DSS Level 1 certified, uses advanced encryption technologies, and has built-in machine learning algorithms to detect and prevent fraud. This high level of security gives businesses confidence in handling their transactions.

Global reach and currency support are other critical advantages. Stripe operates in over 40 countries and supports more than 135 currencies, making it ideal for businesses with an international customer base. This extensive support allows businesses to offer localized payment options, enhancing the customer experience.

Cons

Despite its many strengths, Stripe does have some potential drawbacks and limitations. One common criticism is its fee structure for international transactions and currency conversions. While Stripe’s standard transaction fees are competitive, the additional 1% fee for international payments and currency conversion can add up for businesses with significant cross-border sales.

Another potential limitation is the complexity of some advanced features. While Stripe’s API is powerful and flexible, it can be challenging for less technically savvy users to implement. Smaller businesses without in-house developers may find it difficult to take full advantage of Stripe’s customization capabilities.

Customer support, while generally strong, has received mixed reviews. Some users have reported delays in response times, particularly during peak periods. Although Stripe offers a wealth of online resources, including documentation and community forums, timely and effective support can be crucial for resolving issues quickly.

6. Stripe Software Review 2024: What’s New?

In this Stripe software review 2024, we delve into the latest updates and features introduced this year, exploring how they enhance the overall user experience and what businesses can anticipate in the future.

Latest Updates and Features Introduced in 2024

Stripe continues to innovate and expand its offerings, with several significant updates rolled out in 2024. One of the most notable additions is the introduction of Stripe Financial Connections, a new feature that allows businesses to connect directly to their customers’ bank accounts for seamless transactions. This feature is particularly useful for recurring billing and subscription services, reducing the likelihood of failed payments and enhancing cash flow management.

Another key update is the enhancement of Stripe Terminal, which now supports a wider range of hardware options and offers improved functionality for in-person payments. This expansion makes it easier for businesses to unify their online and offline payment processes, providing a more integrated and consistent customer experience.Stripe has also introduced Stripe Data Pipeline, a powerful tool that enables businesses to export their Stripe data directly into their data warehouse in real time. This feature allows for more comprehensive analytics and reporting, helping businesses make data-driven decisions with greater accuracy and speed.